CFM Unveils ‘Open Fan’ Demonstrator Plan For Next-Gen Engine | Aviation Week Network

CFM Unveils ‘Open Fan’ Demonstrator Plan For Next-Gen Engine

Guy Norris June 14, 2021

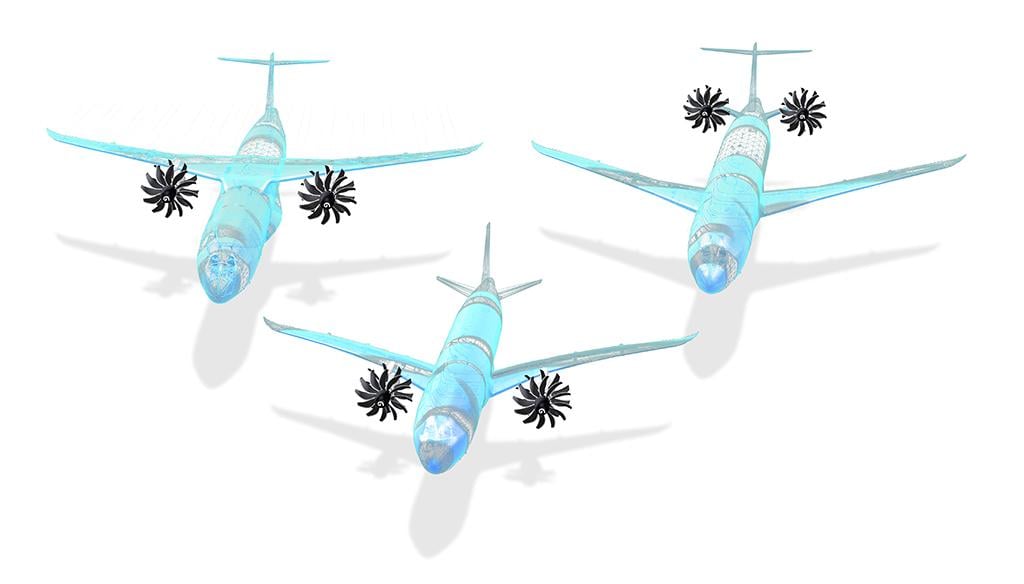

The Open Fan demonstrator will also be a puller, or tractor, configuration with a single stage of rotating blades and a second nonrotating stage of active, variable-pitch stators.

Credit: CFM

CFM International joint venture partners GE Aviation and Safran have launched an aggressive technology development program to pave the way for a new generation of fuel-efficient unducted—or open fan—engines to enter service around the mid-2030s.

Also known as an open rotor engine, the open fan concept increases bypass ratio by eliminating the fan duct and offers double-digit efficiency gains due to a lower fan pressure ratio. The new engine will be developed as part of a suite of disruptive technologies under CFM’s newly unveiled Revolutionary Innovation for Sustainable Engines (RISE) program.

Targeting a 20% reduction in fuel consumption and CO2 emissions compared to current engines, RISE is aimed at the next generation of single-aisle airliners. The open fan program forms the foundation for a potential successor to CFM’s conventional direct-drive Leap-1 turbofan and offers the most realistic development opportunity yet for unducted fan technology since tests of the concept began in the 1980s.

Although the Leap introduced a 15% fuel-burn and emissions improvement over the CFM56 in the late 2010s, the engine-maker acknowledges that fundamental architectural changes will be required to keep next generation powerplants on track to meet internationally agreed targets of halving CO2 emissions by 2050. While much of industry’s research focus is on electric and hybrid-electric systems for smaller aircraft, the power needs of larger aircraft will require continued improvements to gas turbine-based engines—of which the open fan is one.

The switch to a puller versus the dual contra-rotating pusher open-rotor configuration of previous designs will enable flight-testing on existing testbed aircraft and allows for mechanically simpler integration on a potentially wider variety of future airliner concepts. Credit: CFM

As part of the launch of RISE, GE and Safran have also announced an agreement to extend their 50-50 partnership through to the middle of this century. Originally founded to develop the CFM56 in 1974, the joint venture was extended to 2040 when the partnership was renewed in 2008 in the build-up to development of the Leap.

“Through the RISE technology demonstration program, we are reinventing the future of flight, bringing an advanced suite of revolutionary technologies to market that will take the next generation of single-aisle aircraft to a new level of fuel efficiency and reduced emissions. We fully embrace the sustainability imperative,” said John Slattery, GE Aviation president and CEO.

“Our industry is in the midst of the most challenging times we have ever faced,” said Olivier Andriès, CEO of Safran. “We have to act now to accelerate our efforts to reduce our impact on the environment. Through the extension of our CFM partnership to 2050, we are today reaffirming our commitment to work together as technology leaders to help our industry meet the urgent climate challenges.”

As part of the wider focus on sustainability, RISE will also include the development and testing of multiple new combustor designs to ensure future compatibility with sustainable aviation fuels and liquid hydrogen. The demonstrator open fan engines will also be configured with motor-generators to enable them to be adapted to hybrid-electric operation.

“In pursuit of this carbon reduction we think the time is right,” said Arjan Hegeman, general manager of GE Aviation’s advanced technology operation. “The open fan architecture eliminates the whole structure that sits around the fan, so you take a lot of weight out. You take a lot of drag out and you get the ultimate propulsive efficiency. It’s impossible to get any better.”

RISE builds on earlier unducted fan development work by GE and Safran. In the U.S., NASA, GE and the FAA collaborated between 2009 and 2012 on wind tunnel tests of an open rotor with blades developed using modern computer-based design methods. The blades were derivatives of the design used in GE’s GE36 unducted fan—one of two open rotor concepts (along with the Pratt & Whitney/Allison 578-DX propfan)—that were successfully flight tested in the late 1980s.

The wind-tunnel tests, which were conducted as part of the FAA’s CLEEN (Continuous Lower Energy, Emissions and Noise) program, showed a cumulative 15-17 EPNdB noise margin to Chapter 4 (projected to full scale), and hinted at a potential step-change in efficiency. Results from the program suggested a modern open rotor propulsion system could achieve a 26% fuel burn reduction relative to a CFM56-7B-powered narrowbody aircraft.

More recently Safran led a

counter-rotating open rotor (CROR) project that was conducted under the €200 million ($240 million) SAGE 2 (sustainable and green engine) project within Europe’s Clean Sky aeronautics research program. Although this effort, which was based on the core of the M88 combat engine, ended with ground tests in 2017, Safran and GE-owned Avio Aero have proposed a follow-on demonstrator program under Clean Aviation—a successor program to Clean Sky under the European Union’s broader Horizon Europe research and innovation framework to 2027.

Assuming Clean Aviation contracts are awarded, the RISE initiative will therefore be supported in part by European government research funding. “Involvement in various research programs backed by government investment is crucial to ensuring the full maturation of the disruptive technologies required to meet industry sustainability goals,” according to CFM. “Safran Aircraft Engines and Avio Aero are among the main companies shaping how we could participate in the Clean Aviation European research program that will run from 2022 to 2028 and that includes ground and flight demonstrations.”

Unlike SAGE 2, which focused principally on system integration and propulsive efficiency, the RISE open fan will include a new compact core to boost thermodynamic efficiency, as well as new low-emission combustors and motor-generators for hybrid-electric systems.

The RISE design will also be a puller, or tractor, configuration with a single stage of rotating blades versus the dual contra-rotating fan stages of the CROR, GE36 and 578-DX—all of which were pushers. The switch to a puller enables flight testing on some existing testbed aircraft without the need for major airframe modification and allows for mechanically simpler integration.

The engine will incorporate a second non-rotating stage of active variable-pitch stators that will act as flow recovery vanes. The design increases overall fan pressure ratio while simultaneously reducing rotor loading, thus enabling higher maximum flight Mach number. This configuration incorporates a compact high-pressure core, high-speed booster compressor and a high-speed, low-pressure-shaft-driven front gearbox.

“We simplified the architecture compared to the GE36 and CROR,” said Delphine Dijoud, executive manager of the RISE program for Safran. “So, you have just one rotating stage, and after that you have guide vanes which are stators. Both stages have pitch control so you can have variable pitch and reverse capability.” The design eliminates the contra-rotating stage and associated rotating frames. “So it’s better in terms of weight and reliability,” she added.

Meeting the challenges of airframe integration and noise—two key issues with unducted fans—is also becoming easier, said Hegeman. “Over the decades we have been fine-tuning the technologies and our engineering tools to get the acoustics where they need to be. We have also been able to shrink the fan from 16 ft. dia. in this thrust class back in the 1980s to 12-13 ft. dia. today. That’s not much bigger than today’s outside diameter of a nacelle, which makes it very installable on narrowbody-type airframes. So we can hit the acoustics requirements in our thrust class while gaining double-digit performance improvements.”

Hegeman added that the decision to demonstrate the puller configuration does not preclude the development of viable pusher open fans. “If there is an airframer that says, ‘We like the performance, but for our installation and airframe integration purposes it would be better to be a pusher,’ then we just make it a pusher. It doesn’t change the validity of an open fan or electrification. Maybe there are some details that will need to be different, and executed differently, but they are all within the realm of the demonstrator.”

Guy Norris

Guy is a Senior Editor for Aviation Week, based in Colorado Springs. Before joining Aviation Week in 2007, Guy was with Flight International, first as technical editor based in the U.K. and most recently as U.S. West Coast editor. Before joining Flight, he was London correspondent for Interavia, part of Jane's Information Group.

1prime.ru

1prime.ru